Decoding Business Entities: Maximizing Control, Minimizing Liability, and Navigating Compliance

Business Entity Formation

Have you ever considered starting your own small business? Or do you currently own your own small business? Owning your own business offers many benefits. It allows you to follow your passion, control your free time, limit personal liability, minimize taxes, define governance, as well as many other benefits.This chapter discusses the various advantages of a small business and the details of a Limited Liability Company (LLC). As discussed below, the LLC is the most nimble and customizable type of business entity available. Certain comparisons will be made to other types of small business to better describe the differences and benefits of an LLC.

When forming a company, the particular objectives of the business need to be understood. Many types of business entities exist, including partnerships, corporations, and LLCs. Choosing the right entity can be critical. Make the wrong choice, and the consequences can range from annoying to dire.

Types of Business Entities

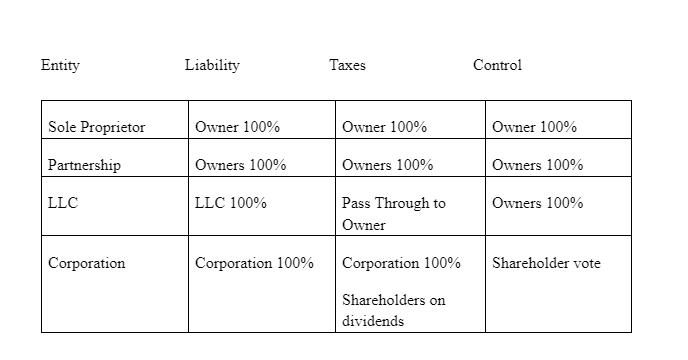

The type of business structure defines how some of those benefits work, such as limiting liability, differing tax structures, various levels of control and governmental regulation. Perhaps the main benefit of owning a company is to separate liability between the company and the individual owner.

That is to say that liability of the business stays with the business and will not touch the assets of the owner, such as their house, personal accounts or other assets.

If there is one owner, the principal choices are sole proprietorship (which technically is not a type of business entity), corporation, or LLC.

If there is more than one owner, the principal choices are partnership (either a general partnership or a limited partnership), corporation or LLC.

Each type of business entity has differing advantages and disadvantages regarding limits on liability, control of the company, tax consequences and regulations that may benefit one business but not necessarily another.

Liabilities of Different Entities

The owners of sole proprietorships and partnerships are fully liable for the obligations of the business, even if the owner has not committed to contribute to it in the future. These business structures do not enjoy limited liability for the obligations of the business, which means that business liabilities are paid by the owners. Tax liabilities are borne by the owners.

By contrast, an LLC and a corporation create a separate legal entity that bears the liability of the company. These business entities have their own Employment Identification Number (EIN) from the IRS. They can (and should) have their own bank accounts, books and records for security and liability reasons.

Maintaining a separation of assets and liabilities owned by the company apart from the assets and liabilities of the owner(s) helps demonstrate how a corporation or LLC limits the owner’s liability. For example, if an LLC is filed with the State and nothing else is done, it may not protect the owner from liability. Without a separate bank account, EIN or an Operating Agreement, all revenue comes straight to the owner and all the liability is paid by the owner.

The business should not be used as a “piggy bank” for the owner. Simple ways to maintain this separation include separate bank accounts for the business and the owners, and separate ownership of assets (vehicles, real estate, office equipment are not bought by the company and used for personal tasks).

Bluntly stated, if the business commingled assets with the owner, a court will commingle the liability amongst the business and the individual, and thus, hold the individual liable for the actions of the business. Additionally, this separation of liability can be destroyed if the owners act illegally, or grossly negligent in their performance of business tasks.

Business Ownership and Control

One of the most hotly debated issues for business owners is control. Control can be more easily and flexibly allocated in a non-corporate form, such as an LLC. Whereas corporations have more strict procedural requirements. Nonetheless, knowledgeable counsel can achieve much of the desired flexibility in corporate form, though typically the legal fees are higher since the corporate form is less flexible and requires more legal work to achieve the desired flexibility.

One of the most significant tax aspects is whether the business is a “flow-through” entity, whereby income of the business flows through to the owners of the business for tax purposes, and each owner pays income tax on their share of the business’s income.

A limited liability company is perhaps the most agile and owner-friendly business structure. The LLC maintains the liability of the company separate from the owners. Income, debt and taxes pass through to the owners in proportion to their ownership percentage.

The owners report LLC income as a schedule on their personal tax returns. Further, the LLC gives its owners wide latitude to control the management and the form of the business as they choose. No required annual meetings, no required board members, no required distributions or contributions necessary. Many closely held companies prefer the flexibility and control that an LLC offers.

Corporations have many requirements: annual meetings, board members, quorums for votes, etc. The liability of the corporation is separate from the individual owners (shareholders). Corporate income and debt remain the sole responsibility of the corporation.

The owners (shareholders) may receive dividends of wages, which is the only income the shareholder must report on their taxes. The corporation files its own tax return, which has its own cost. Notably, until recently, only corporations could attain non-profit status. Regulations have recently changed to allow certain LLCs to apply for a non-profit status.

The type of business you operate may dictate the governance structure of your small business. An LLC can be managed by a vote of the owners (Members) or by a designated Manager. The State of Michigan now requires named Managers to manage cannabis companies. This recent change allows the State to regulate and perform background checks on the Managers.

While starting a business can be rather simple, doing it properly is key. Let’s look at a Limited Liability Company (LLC) as an example. Filing the Articles of Organization online with the State is simple. Obtaining an EIN from the IRS takes only a minute or two online.

Importance of Operating Agreements

At this point you have a viable company that is registered and subject to taxation, however, you are not ready to transact business.

An LLC needs an Operating Agreement as a blueprint for the company, to define the rights, responsibilities and expectations of the owners. The Operating Agreement defines who the owners (Members) of the LLC are and amount of their ownership. Many banks require an Operating Agreement to be signed before they will open an account for an LLC, so that they know who the individuals are that have authority on behalf of the LLC.

The Operating Agreement names the members and defines the amounts of their interest. It can name the Managers and describe their authority to run the company. The Operating Agreement also lays out how the company internally operates. It describes how new members will be admitted into the LLC: do all members need to agree on the new member or only a majority interest in the LLC.

The Operating Agreement likewise describes the procedure for removing a member: buyout, expulsion, death, etc.

Important Provisions and Areas of Focus

Two particular areas that are essential to an LLC are the Involuntary Transfer provisions and the Deadlock provisions in an Operating Agreement.

Involuntary Transfers

Involuntary Transfers involve how a member’s ownership interests are handled in the case of unexpected life events. The following examples illustrate how the LLC is protected from an outside person gaining leverage over the LLC through an unforeseen event. The LLC was not formed with the intent to partner with a bankruptcy trustee, an ex-spouse or an heir. The LLC is jeopardized by the interference of these outside actors or by the actions of a court following one of these unfortunate events.

· If a member of an LLC files for bankruptcy, the member’s interest could be seen as an asset in the bankruptcy that is managed by the bankruptcy trustee. Not only would the value of the membership shares be added to the member’s assets and potentially disqualify the member from obtaining a bankruptcy discharge, but the trustee could seek to manage those assets on behalf of the member.

Accordingly, an LLC can protect itself from the unexpected bankruptcy of a member by proscribing a process for an immediate transfer of membership interest the moment that a bankruptcy is filed. A bankruptcy petition triggers a series of events to protect the company. The member’s ownership interest is offered for sale to the company at a predetermined price (often a calculation based upon recent financial information). This process would keep the LLC out of the bankruptcy and assure that the bankruptcy trustee is not managing the membership interest.

· Should a member get divorced, the membership interest could be treated as a marital asset. The member’s ex-spouse may or may not be well qualified to become a member of the LLC, but it is unlikely that the remaining members would like to negotiate business with the ex-spouse.

Involuntary Transfer provisions would protect the LLC by triggering an offer to sell that member’s interest in the LLC at the moment that a divorce case is filed. The membership interest is then sold at the predetermined price to the LLC, the other members of the LLC or to a new member. The ex-spouse is left with claims to the proceeds of that sale but is not a part owner of the company.

· Death is another unforeseen event but one that is eventually certain. The death of a member can cause many unfortunate consequences to a business, including loss of a valued member of the LLC.

An Operating Agreement can prevent issues if a member dies. It does this by using Involuntary Transfer rules. These rules keep the LLC out of probate court and prevent disagreements among the deceased member’s heirs.

Instead, the deceased member’s interest in the company is offered for sale at that predetermined price. The proceeds of that sale are then part of the deceased member’s estate.

Deadlock Provisions

Another provision in an Operating Agreement that is essential to avoid problems in the business later is a Deadlock provision.

Deadlock occurs whenever members of the LLC cannot agree on a particular course of action. Whether the LLC is owned by two members with equal voting rights, or a unanimous vote is required by all the members, a disagreement could result in a deadlock whereby one member can block the actions of the other member.

For example, if an LLC with two equal members is looking to purchase a building, one member could block the purchase by refusing to sign the purchase agreement. In such a situation, a Deadlock provision in the Operating Agreement could resolve the impasse.

Deadlock can be resolved in a number of ways without resulting in a lawsuit or the dissolution of the LLC. Sometimes, the mere possibility of the Deadlock provision can encourage a member to negotiate more reasonably to avoid the Deadlock.

What to do During a Deadlock?

Below are a few examples of common Deadlock procedures.

· Perhaps the most widely understood procedure is the appointment of a tiebreaker. The Operating Agreement could name a third-party to cast a vote and break the tie. Alternatively, it could state that each member can name a tiebreaker, and that each of those named people then agree on a third tie breaker.

· Another option could be a predetermined buy-sell agreement. In this option, one member will make an offer to buy out the other member at a specific price and other terms. The offeree must either accept and sell at the designated price and terms or buy the offeror’s interest for the same price and on the same terms originally offered, assuming the owners have equivalent percentage interests in the LLC.

· A slight variation of the buy-sell option is where one Member declares the deadlock and then writes down a price that they believe the business membership interest is worth. In a 50/50 split, one member could determine the value of the company to be $1,000,000 so the 50% interest would be worth $500,000. The other Member may then decide if they want to purchase that 50% interest for $500,000 or sell their 50% interest for $500,000.

This option dissuades members from declaring a deadlock when the issue can be otherwise resolved, and encourages good faith estimates of the business value because the member setting the price, does not know if it is the purchase price or the sale price.

· An auction is another option when two or more members compete for control of the company. One member offers to purchase the other member’s shares, which begins a bidding process. The highest bidder buys out the other member’s interest at the highest bid.

These are just a few examples of how deadlock can be resolved, but there are many more. Regardless of the procedure, the goal is the same: to protect the business so that it may continue and succeed.

Recent Legal News: LARA and FinCEN

A law that went into effect on January 1, 2024 impacts virtually all business that have registered with the State. The Financial Crimes Enforcement Network (FinCEN) was created as part of the Corporate Transparency Act. All LLCs and Corporation (any business entity) created and registered with LARA is subject to the reporting requirements (with 23 exceptions). Basically, the company needs to report who the actual individual is who is in charge (name, address, SSN, DOB, DLN, etc).

– Any company started before January 1, 2024 must report by December 31, 2024.

– Any company created after January 1, 2024 (but before January 1, 2025) has 90 days to report.

– Any company created after January 1, 2025 has 30 days to report.

Failure to report by the deadline can result in fines of $500 per day, plus criminal penalties up to $10,000 and 2 years in jail.

Learn More about how we service small businesses just like yours!

Listen to Our Small Business Podcast!

Follow us on Social Media!